The Next Behavioral Finance Mistake

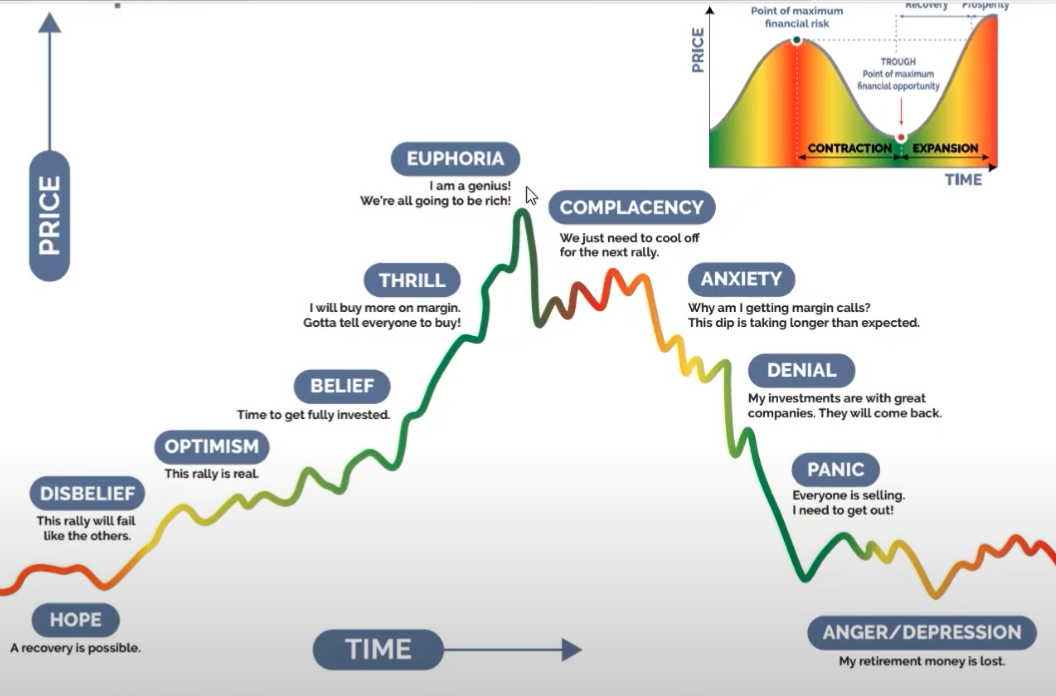

Most people look at index returns and think those would have been realized returns if they had invested in XYZ. The reality is that is completely wrong of course. What matters is WHEN you buy and WHEN you sell. Unfortunately, many Meme or Speculative Tech investors learned this the hard way in the last few years. That is, when you buy into a mania, you are often buying in near the top of the run.

Similarly, when there is "blood in the streets", everyone is trying to get out of the market. During 08-09 GFC, people saw their 401k turn into a 201k over just a few months. It's not easy when you see 20 or 30 years worth of savings cut in half that quickly. You worry about losing even more and get out, and sadly, that turns out to be near the lows.

The emotions around investing are challenging to manage. Personally, I am not very emotional. An ex-girlfriend actually said I had no emotion whatsoever. Yikes. 😐 (In my defense, I was breaking up with her and wasn't particularly sad about it)

I think that was a bit judgy, but I concede I am pretty even keeled 99% of the time. I do think that has helped me throughout my career, but it doesn't necessarily make investing easier, mainly because EVERYONE ELSE is emotional. 😂

My point is that emotions cause investors to make "behavioral mistakes" which ultimately dramatically affects their realized returns.

And here's the problem.

Right now, more and more and more and more OLDER investors hold a much higher weight in equities than ever before.

The reason is most likely due to the suppression of rates since the GFC which pushed many "savers" out on the risk spectrum to try and find some return. Combine that with a structural tailwind from passive investing and sprinkle some FOMO, and Voila! You have 70 year olds with 70-80% equity exposure.

Why is that a big deal?

Well, investors have very short memories and only focus on returns. They forget about things like "volatility" and "valuation".

This matters because (and I'm summarizing my accumulated findings over the years) when market cycles change, many large cap stocks often decline roughly 50-70%, small caps and more speculative stocks decline 70-90%.

The good news is that if you are invested in a broad based large cap index, the downside risk drops to 30-50% on average. Score one for diversification.

With elevated equity holdings among older investors, I think there is a higher probability for behavioral mistakes in the coming years. And while I am a long-term bull (although you may doubt that), taking a large drawdown near or early or late in retirement can dramatically impact your financial plan.

If you're a financial advisor, please proactively have these discussions with clients and prepare for the next cycle change. (whenever it inevitably comes)